For decades, buying a home was seen as a major milestone of adulthood. But in 2025, many young adults in Atlanta are “swiping left” on traditional homeownership—and doing so intentionally. Rising costs, lifestyle flexibility, and shifting priorities are redefining what success and stability look like for millennials and Gen Z.

Atlanta, one of the fastest-growing metro areas in the U.S., is at the center of this change.

Rising Home Prices and Affordability Challenges in Atlanta

One of the biggest reasons young adults are delaying or avoiding homeownership in Atlanta is affordability. While the city remains more affordable than markets like New York or Los Angeles, home prices in metro Atlanta have increased significantly over the last decade.

- Higher down payment requirements

- Rising interest rates

- Increased property taxes and insurance costs

For many young professionals, renting offers financial breathing room while allowing them to build savings, invest elsewhere, or pay off student loans.

Flexibility Over Fixed Assets

Today’s young adults value mobility and flexibility more than previous generations. Atlanta’s strong job market—especially in tech, film, logistics, and startups—often requires changing roles or locations quickly.

Renting allows:

- Easier relocation for career opportunities

- No long-term maintenance responsibilities

- Freedom to upgrade or downsize as lifestyles change

For many, locking into a 30-year mortgage feels restrictive compared to the flexibility renting provides.

Lifestyle Preferences Are Shifting

Urban living, walkable neighborhoods, and access to entertainment matter more than square footage for many young Atlantans. Areas like Midtown, Old Fourth Ward, and West End attract renters who prioritize:

- Proximity to work and nightlife

- Amenities like gyms, pools, and coworking spaces

- Low-maintenance living

Owning a suburban home doesn’t always align with these lifestyle goals—at least not yet.

The Influence of Student Debt and Financial Caution

Student loan debt continues to play a major role in delaying homeownership. Even with solid incomes, many young adults prefer to focus on:

- Paying down debt

- Building emergency funds

- Investing in stocks or businesses

The Atlanta market has seen an increase in financially savvy renters who view homeownership as one investment option—not the only path to wealth.

Changing Views on the “American Dream”

For previous generations, owning a home symbolized stability and success. Today’s young adults define success differently. Experiences, work-life balance, entrepreneurship, and travel often take priority over property ownership.

In Atlanta, this mindset is reshaping housing demand, with:

- Strong rental market growth

- Increased demand for mixed-use developments

- Growth in build-to-rent communities

What This Means for the Atlanta Housing Market

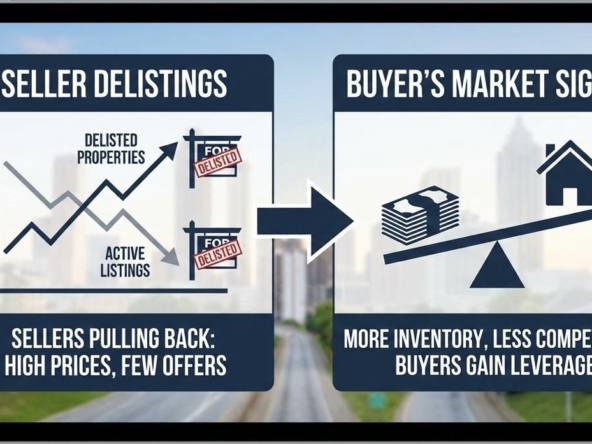

The shift away from immediate homeownership has real market implications:

- More inventory pressure on entry-level homes

- Increased demand for rental properties and multi-family developments

- Opportunities for investors targeting long-term renters

At the same time, many young adults aren’t rejecting homeownership forever—they’re simply delaying it until the timing feels right.

Will Young Adults Buy Homes in Atlanta Eventually?

Most experts agree that homeownership is still part of the long-term plan for many young adults. Major life events—marriage, children, career stability—often change priorities.

When that happens, Atlanta remains an attractive market due to:

- Job growth

- Relatively affordable suburbs

- Strong long-term appreciation potential

The key difference is when and why they buy—not whether they ever will.

Young adults in Atlanta aren’t abandoning homeownership—they’re redefining it. By prioritizing flexibility, financial stability, and lifestyle, they’re making choices that reflect today’s economic realities.

As Atlanta continues to grow, understanding these generational shifts is crucial for buyers, sellers, investors, and real estate professionals alike. The future of homeownership isn’t disappearing—it’s evolving.